Follow me @TheBon_Scott on Twitter, and please share this newsletter if you find my work valuable.

Nvidia’s revenues and earnings have grown tremendously over the past 2 years, and that growth rate will eventually slow — it’s the law of big numbers — but should remain strong for the foreseeable future. The key is does the company continue to see good-to-strong growth in its business and AI’s adoption and implementation as a broad-industry productivity enhancement tool. It almost certainly will.

Nvidia (NVDA) reports 2nd quarter earnings after the close on Wednesday, and expectations are once again sky high-high for the chipmaker. The consensus earnings estimate is $5.54 per share on revenue of $24.17 billion, representing 236% year-over-year revenue growth. The “earnings whisper number” is $5.80 per share. The company's guidance was for earnings of $5.18 to $5.64 per share on revenue of $23.52 billion to $24.48 billion. One again, investors are very bullish going into the report, expecting the company to handily beat estimates and further raise guidance above current consensus expectations.

Before I go into potential market reactions to Nvidia’s results, let’s take a look at the broader market picture for context. I’m aware that I keep repeating myself, but I’ve been continually maintaining my view that the market environment will remain constructive, due to solid-to-good earnings growth after 2023’s “earnings recession,” and that it would take a significant spike in Treasury yields, or serious recession concerns, to thwart it in big way. Recall that the market held up pretty well despite 3-straight months of higher-than-expected “sticky” inflation data.

We’ve now recently received 2 reassuring inflation data reports, the April jobs report showing that wage growth had come in less-than-expected, and this past Wednesday’s CPI report that came in less-than-expected: a slight de-acceleration, with the April CPI coming in 3.4% versus the 3.5% consensus expectation. Not perfect, but trending in the right direction after 3-months of hot CPI reports, and that was music to the market’s ears.

Last weekend I wrote that the market was on good footing, breadth continued to be bullish, and the path of least resistance was up. And, if Wednesday’s CPI report came in better-than-expected, we would likely see new highs on the major indexes fairly soon. It didn’t take long as the market rallied strongly on the CPI report, and broke out to a new high that day. Make no mistake, this is a healthy/bullish technical setup that is being confirmed by a constructive macro environment (solid economy with inflation improving, albeit slowly), and good fundamentals (good earnings growth).

The tech-heavy and mega-cap heavy Nasdaq 100 index also broke out on Wednesday, and the Nasdaq Composite and the Dow Jones Industrial Average broke out, as well. It’s a good, healthy broad-based rally.

The market rested a little on Thursday and Friday, but some profit-taking isn’t surprising after a nice 3.5 week market rally. That brings us to Nvidia’s earnings this Wednesday.

I see Nvidia is a probable additional positive market catalyst. The market’s already in good shape, in part, because of the productivity enhancements that AI is beginning to provide. A strong and well-received Nvidia earnings report & guidance is just going to bolster the already positive environment. A “lukewarm” response to the Nvidia’s results (i.e. “They were really good, but not jaw-dropping good”), won’t derail the bull market, it’ll just shift affect some of the rotation and money flows within the large market of stocks.

Of course, a stock or the market’s reaction to news is more important that the news, itself, so you take your cue from the market and don’t fight the tape.

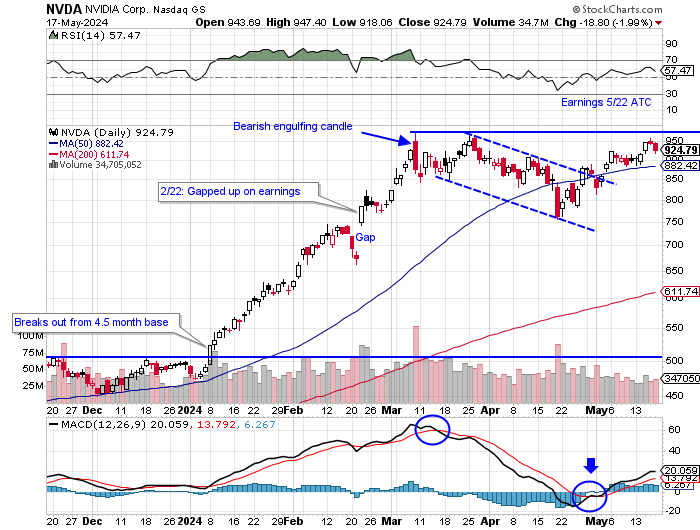

One reason to be optimistic about the coming market reaction to Nvidia’s earnings report is that that the stock has been consolidating and basing for the last 9-10 weeks (since May 8th). If a stock has rallied strongly in advance of its earnings report, it significantly increases the chances of a sell-on-the-news reaction by the market upon receiving the anticipated good news.

As an example, and involving Nvidia specifically, in August of last year I wrote, Nvidia's Blowout Earnings Provide a Good Sell On the News Opportunity. In that situation, Nvidia had just had an incredible 415% rally off of its October 2022 bear market low. That rally had been further fueled when after the close of May 24th, 2023, Nvidia reported its 1st quarter earnings and surprised the market with very strong revenue and earnings growth, and a blowout raise of its forward guidance — a huge dollar amount guidance raise that was previously unheard of for a company of its already considerable size. The stock gapped up and rallied another 24% the next day, and continued to rally until its next earnings report.

At the time of that May 24th, 2023, earnings report, Artificial Intelligence (AI) was still in its relatively early days of being a huge “thing.” Now the world knew the potential for AI and that Nvidia’s revenues were going to ramp substantially. The stock continued to rally strongly, and then after the close on August 23rd it reported second quarter earnings. As expected, it again handily beat street expectations and raised forward guidance above current consensus expectations. But this time the market wasn’t taken by complete surprise; the stock had rallied 400% over the prior 10 months, and there were plenty of happy profits to be taken.

As I wrote the day following that August 2023 earnings report, it was a situation that was ripe for profit-taking and some substantive consolidation. The stock then consolidated/based for the rest of the year before breaking out in early January of this year after some very-well received new product announcements at the CES Technology Conference.

On February 22nd of this year, Nvidia’s already-strong 2024 rally was bolstered by another very strong earnings report (4th quarter) and guidance raise. The stock finally started to take a rest, and consolidate, in the second week of March. At the time, I wrote that Nvidia’s March 8th intraday downside reversal likely marked a medium-term top for Nvidia and the semiconductor sector. Nvidia and the Semiconductor Sector ETF (SMH) have been consolidating since, and that brings us to this week’s 1st quarter earnings report from Nvidia.

You could say that the stock is “rested” going into the report; it’s not particularly ripe for a sell-on-good news kind of situation.

Another reason to be optimistic about Nvidia’s coming earnings report is recent positive AI chip market comments from Taiwan Semiconductor (TSM). TSM is the world’s largest semiconductor foundry (contract chip manufacturer), and in a May 10th sales report update it had very positive things to say about the growth in its AI chip manufacturing business, of which Nvidia is by far its largest customer, as you would expect.

I think the chances of the Nvidia actually “disappointing” the market with its report and forward guidance is quite low. The issue, once again, is does it measure up to its sky-high expectations. If it doesn’t, for whatever reason, I’ll adjust my optimistic semiconductor sector and/or market view, on the spot.

As I’ve often written, I’ll change my market view on a dime if the news, tape and the technicals warrant it. It’s been a very, very good year for the WMI portfolio, and I won’t remotely feel any sense of lost opportunity gains if I suddenly get more defensive, but I think it’s more likely that the market gets an additional boost from Nvidia’s earnings and forward guidance than it causing a material broader market pullback if the company doesn’t sufficiently “excite” with its report.

That’s it for now, I’ll write more soon. And as always, I’ll be posting frequent market commentary on WMI’s private Twitter (X) page.

On to a new/updated focus watchlist.

Focus Watchlist

I try to recommend trades that are timely and that a breakout/breakdown is likely to occur soon. If I take a stock or ETF off the focus watchlist, it may be because the trade needs more time to ripen, it ran away from us, or I’m no longer considering it at all.

Longs:

Keep reading with a 7-day free trial

Subscribe to Wade's Market Insights to keep reading this post and get 7 days of free access to the full post archives.